|

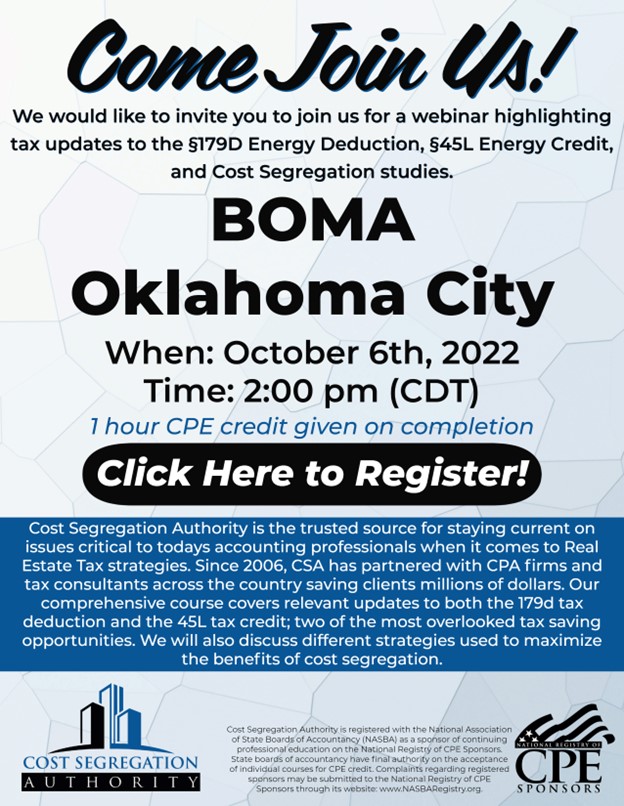

Virtual Seminar: Cost Segregation Authority Tax Updates

Thursday, October 06, 2022, 2:00 PM - 3:00 PM CDT

Category: Events

Tax Updates – 179(D)

&

Cost Segregation Strategies

-Introduction

• Presentation Objectives

-§179(D) Tax Deduction

• What is the §179(D) tax deduction?

• How does it work? Who qualifies?

• Changes to §179(D)

• Quiz Question #1

-§45L Tax Credit

• What is the §45L tax credit?

• Qualifications for credit

• Frequently asked questions

• Quiz Question #2

-Cost Segregation

• Depreciation

o Property Classifications

o Bonus & Super Bonus Depreciation

• Case Studies

• Bonus Benefits

o Partial Disposition

o 1031 Exchange

o Catch up Benefit

• Quiz Question #3

-Conclusion

• What this all means

• Final Thoughts

|

Prev Month

Prev Month View Month

View Month Search

Search Go to Month

Go to Month Next Month

Next Month

Export Event

Export Event

%20(4.125%20×%208.5%20in)%20(Website).png)